How to Register with the Income Tax Department for E-Filing of Income Tax Return

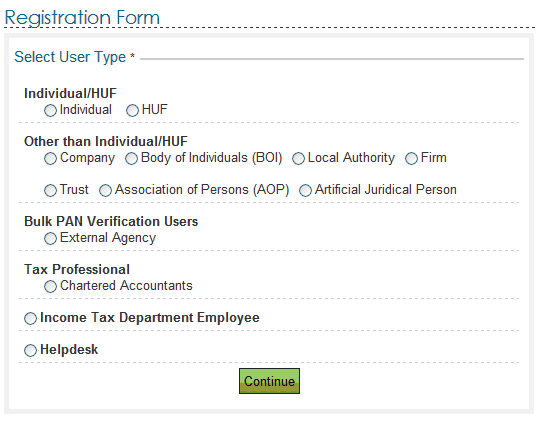

Process of registration with Income Tax Department website for e-filing of Income Tax Return or checking of current Income tax deduction amount. To file the income tax return person has to register/create account with the income tax website on click on the Registration Form. By registering on Income Tax Website one check his TDS status through AS 26 Form and one can verify the address given by him/her to Income Tax Department. Income Tax address is given at the time of applying for PAN card. So PAN card address can be verified by creating login id.

After Registering with Income Tax Department you can check following Details

- Online filing of Income Tax Return

- Download Past Filed Income Tax Returns (Online Filed Only)

- Income Tax Return Processing Status

- Income Tax Return Processing Status

- Income Tax Refund Status

- Income Tax Demand Status

- Income Tax Refund Reissue Request

- Current Postal Address of the Assessee

- PAN Card Details

.

For Registration You should be ready with your PAN Card copy for Verification of your details like

-

PAN Card Number (Which is user id for the Income Tax Website)

-

Name of Person as per PAN Card

-

Father name given in PAN Card

-

Date of Birth as per PAN Card

-

Address of Person (is Compulsory)

-

Mobile Number (is Compulsory)

-

Landline /Telephone Number

-

Email Id (is Compulsory) and which is active because on this id Income Tax will send you the Email /Link for Account Activation

-

Password (Which should be noted down, saved on safe place because you can’t change it very easily, if you don’t have other details of your Income tax website account)

-

Secret Question Answer (Should be noted down, saved on safe place)

Contact Details (Toll Free Number) for e-filing of Income Tax Return How to Reset the Income Tax Password for E-Filing of Income Tax Return

for e-filing purposes

for individual IT e-filing purposes

Dear Sir/Madam,

I Prashant Sharma like to file tefund through this site But I saw that page cannot be displayed.

Please help me,

With Thanks–Prashant Sharma

Mobile-

Prashant Sharma Ji,

Efiling of Income Tax return for Year 2012-13 i.e. AY 2013-14 is not available. And Income Tax Deptarment will soon issue excel utility for AY 2013-14 and then only you can file income tax return. and Last date for Income Tax return is 31st July 2013

Dear Sir,

Have filed Returns for AY 2011-12 & 2012 -13, but not received the Refund Cheque yet. Khanda Colony IT Office says 2011-12, approval is given and the manuel cheque will be issued by SBI Andheri Branch.

Not Understanding whom to contact as toll free no of SBI also says they have no records for tracking the Refund Status. Kindly help.

Rgds/Manish

Sir my Refund cheque reference Number CMPS1118567 has been returned by post man undelivered on 18 May 2013, Speed post ref No E1407878173IN.

Please arrange to reissue my refund cheque at the earliest at my official address or my residential address enumerated below :-

Records, The Mahar Regiment (MRC)

Saugor (MP)- 470001 .

My PAN No is ASBPK5165D

MY Date of Birth is 05/09/1972

AY-2011-12

I have the same address but I could not received the Refund. Please kindly help me.

My CA did the IT registration for efiling and mentioned his mail id as primary and not gave alternate mail id. Now I have changed my CA for the efiling purpose.But he changed login password so I cannot open my account.

Reset password is going to CA’s mail id and he is not giving me the same.

Please tell me how I can change primary mail id with my own id so nobody can change password in the future.

i tried to reset password with the site you mwntioned. but the issue is still open . reset password is going to Primary ID which is of my earlier CA. How to change primary ID is important to know. could you please help

still waiting for the answer

HI SIR,

HOW TO FIND CPC COMMUNICATION NO AND CPC REFUND SEQUENCE NO

HI,

can u tell me my cpccommunication reference no and cpc sequence no for assessment year 2011-2012 pan no AHOPB6770F

for Individual Inocome taxe-filing purpose

How can i get CPC Communication Reference Number & Refund Sequence Number(As per CPC Order), My pan no.:AA

please login authority of status my income tax itr

Just want to verify due date for registration 2012 – 2013

I cannot access the site “incometaxindiaefiling gov in/e-Filing/Registration/RegistrationHome.html” but the site give a message “”You attempted to reach , but the server presented an invalid certificate.”

Please advise how can I fix it and to register IT e-filing.

I tried to access the site “incometaxindiaefiling.gov.in/e-Filing/Registration/RegistrationHome.html” several times but the site keep giving a message “”You attempted to reach incometaxindiaefiling.gov.in but the server presented an invalid certificate.”

Please advise how can I fix it and to register IT e-filing.

Hi,

Still i didn’t get refund amount for the AY – 2008 to 2009. I filled form 16 through the agent. I forgot my Acknowledgment number. How can i get Acknowledgment no, CPC number, and Refund Sequence Number? Please help me on this.

Thanks,

Raghu

how to reg e filling

sir my pan no: ATXPK9467F , adress is changed, please send refund year of 2010-11,my new adress k.kashireddy,6-40,po road,peddakothapally (po) mahabubnager (dist) ap pin:509412

please furnish the address as per my PAN card

I have tired in many ways to reset the password. Even, I have 2 to 3 e-mails to concern department more than a week ago. But, so far I haven’t get any response. I need to e-file my returns on time. Please do needful.

Thanks & regards,

Sundaresan

INEW RESISTRATION OF INCOM TAX OFFICE

HOW CAN I REGISTRED FOR FILLING INCOME TAX RETURN ON LINE.

i am a employee in private limited company,I want to verify a Pan Number for office use,Please tell me about this.thanking You

Dear Sir,

ITR E-filed,but not received acknowledgement, for the AY 2010-11 and 2012-13.

I have received latter from tax office ward 8(3) Baroda,on sub Non filling of Income tax return reg. Ref no. NMS/AOXPM7591K/805166/p5/48d.

Pl. suggest me to how to confirm IT dept about my ITR E-filed.

Thanks And regards

Goureesh Girimallayya Mathapati, PAN: AOXPM7591K.

i have not received refund for A.Y.2011-2012 due to return of refund

i forget my income tax id

Income id is your PAN Number