MCA has introduced new form INC 29: Single incorporation form for formation of companies in India. Now instead of filing E- Forms DIN-3, INC-1, INC-7/2, INC-2 & DIR-12, applicant has to file INC- 29, it is a single form in place of five different ROC forms. INC 29 is single integrated form with application for name, application for DIN, Application for Incorporation and Application for PAN, TAN and ESIC Number. This form can be used by OPC and other company. Applicant has attach MOA, AOA, Director & Shareholder affidavit cum Declaration, Proof of address of company, Proof of Address & Identity for Directors and Shareholders with form INC 27. Applicant can apply for DIN, PAN, TAN & ESIC through INC 29 Form at the time of incorporation of company only.

EForm INC-29 deals with the single application for reservation of name, incorporation of a new company and/or application for allotment of DIN. This eForm is accompanied by supporting documents including details of Directors & subscribers, MoA and AoA etc. Once the eForm is processed and found complete, company would registered and CIN would be allocated. Also DINs gets issued to the proposed Directors who do not have a valid DIN. Maximum three Directors are allowed for using this integrated form for allotment of DIN while incorporating a company.

Details & Process of Incorporation of Company in India using single Form INC 29

- Type of Company: Producer Company, New company(Other: Private or Public)

- Class of Company: Public, Private or One Person Company

- Category of Company: Company limited by shares, Company limited by guarantee or Unlimited company

- Sub-Category of Company:Union government company, State government company, Non-government company, Subsidiary of foreign company, Guarantee and association company

- Company Having share capital or Not: Yes or No

- Main division of industrial activity of the company: Agriculture and Allied Activities, Mining & Quarrying, Manufacturing (Food stuffs), Manufacturing (Textiles), Manufacturing (Leather & products thereof), Manufacturing (Wood Products), Manufacturing (Paper & Paper products; Publishing, printing and reproduction of recorded media), Manufacturing (Metals & Chemicals, and products thereof), Manufacturing (Machinery & Equipments), Manufacturing (Others), Electricity, Gas & Water companies, Construction, Trading, Transport, storage and Communications,Finance, Insurance, Real Estate and Renting, Business Services, Community, personal & Social Services.

- Whether standard template of MoA as prescribed under schedule I to the Companies Act, 2013 is opted for adoption: if YES then Details like Name applied, capital clause, details of the subscribers/member and their liabilities, State wherein the registered office is to be situated, proposed objects of the company etc. should be given suitably under the relevant clauses of MoA.

- Whether standard template of Articles of Association (AoA) as prescribed under schedule I to the Companies Act, 2013 is opted for adoption: Select Yes or No

- Whether Articles of Association is entrenched: Select whether the article(s) is/are entrenched compared to the standard template of Articles of Association

- Capital structure of the company: In case of a company having share capital, enter the details of authorized and subscribed share capital break up. Minimum authorized and subscribed share capital required for an OPC or a private company having share capital is Rupees one lakh and in case of a public company is Rupees five lakhs. Also enter the number of shares, total amount of shares and nominal amount per share for each kind of shares. At least one kind of share capital (Equity/ Preference) should be greater than zero in number of shares as well as amount of shares.

- Details of number of members: Enter the details of number of members

- Correspondence address: Enter the correspondence address of the proposed company.

- Whether the address for correspondence is the address of registered office of the company: If Yes attach the proof of office address and copy of utility bill that is not older than two months

- Name of the office of the Registrar of Companies in which the proposed company is to be registered: Select the RoC name displayed based on the state selected in correspondence details

- Particulars of the proposed name: Enter the particulars of the proposed name.State the significance of the key or coined word used in the proposed name. It should mention why such word cannot be done without in the name.

- Whether the promoters are carrying on any Partnership firm, sole proprietary or unregistered entity in the name as applied for : If yes, whether the business of such entity shall be acquired.

- Whether the proposed name contains name of any person other than the promoter(s) or their close blood relative(s): Select the Yes or No option.

- Whether the proposed name includes the name of relative(s): Select the Yes or No option. If yes is selected, then attach the proof of relation of the relative with promoter.

- Whether approval from any sectoral regulator is required: Select whether the approval is needed from any sectoral regulator.

- Whether the name is similar to Existing Indian Company, Foreign body corporate: if yes then get NOC and CIN No of Company

- Whether the proposed name is based on a registered trademark or is subject matter of an application pending for registration under the Trade Marks Act: if Yes then hen approval shall be attached of such owner of the registered trademark

- Specify the class(s) of trademark: if yes to above answer also Furnish the particulars of application and the approval of the applicant or owner of the trade mark

- Number of first subscriber(s) to MOA and directors of the company: Enter the number of first subscribers to Memorandum of association (MoA)) and directors of the company

- Total number of directors (including subscriber cum director):This number should include number of those subscribers who are also proposed to be director in the company.Directors not having DIN cannot be more than 3 in number

- Number of individual first subscriber(s) cum director(s): Particulars of directors (Subscribers cum director) – having DIN & not having DIN, shall be generated accordingly

- Number of individual first subscriber(s) other than subscriber cum director: Particulars of individual first subscriber(s) (other than subscriber cum director) having DIN & Particulars of individual first subscriber(s) (other than subscriber cum director) not having DIN.

- Number of non-individual first subscriber(s): Particulars of non-individual first subscriber(s) not having DIN: Enter the personal details, occupational details and educational qualifications. Select a personal identification document available with the director – PAN or Passport Number. In case director is an Indian national, select PAN option. Enter the Designation from the available drop-down values – Director/ Managing director/ Whole time director/ Nominee director. Enter the email id of the proposed director. Make sure that the email ID is correct. Enter the address details of the proposed director.Select the type of the Proof of identity from the available drop-down values – Voters Identity Card/ Passport/ Driving License/ Aadhar Card. Select the type of Residential Proof from the available drop-down values – Bank / Electricity Bill/ Telephone bill/ Mobile bill. Attach copy of proof of identity and proof of address under attachments section.Enter the number of other entities in which director have interest

- Particulars of directors (other than first subscribers) Having DIN: Enter the particulars of directors (other than first subscribers) that have DIN.

- Nomination: Enter the name of subscriber and nominee in case company is One person company

- Particulars of the Nominee: Enter the DIN if nominee is having a valid DIN, In case nominee don’t hold a valid DIN, enter the Income-Tax PAN of the nominee director and click the Verify Details button, proof of identity like Voters Identity Card/ Passport/ Driving License/ Aadhar Card Statement, Residential Proof like Bank / Electricity Bill/ Telephone bill/ Mobile bill.

- Particulars of payment of stamp duty: The State or Union territory will be pre-filled based on the address of the proposed company

- Whether stamp duty is to be paid electronically through MCA21 system: Select whether you will be paying the stamp duty electronically through MCA21 system or not

- Details of stamp duty to be paid: If you selected to pay stamp duty through MCA21 system or if Stamp duty is not applicable, the details of stamp duty to be paid would get auto-filled

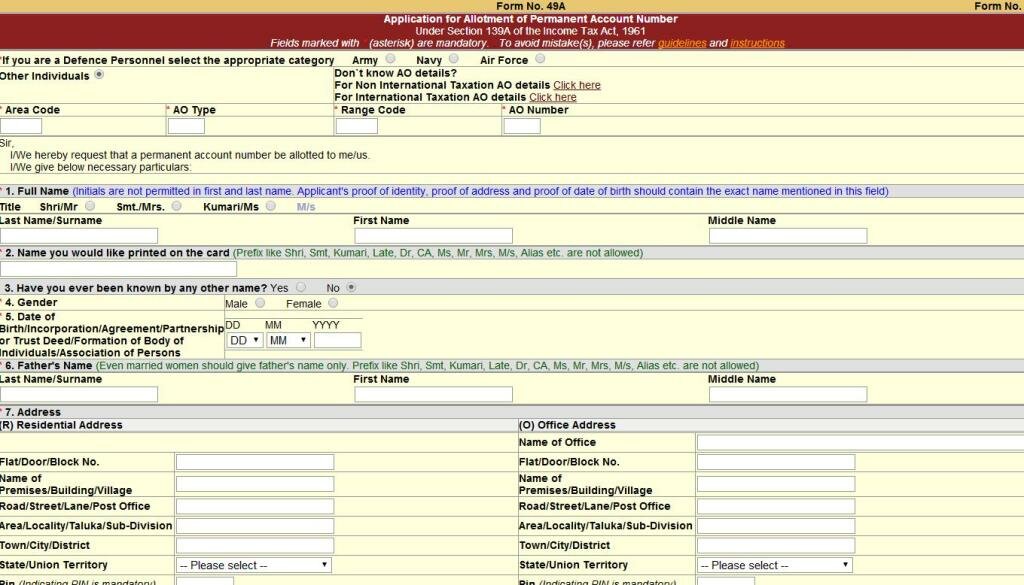

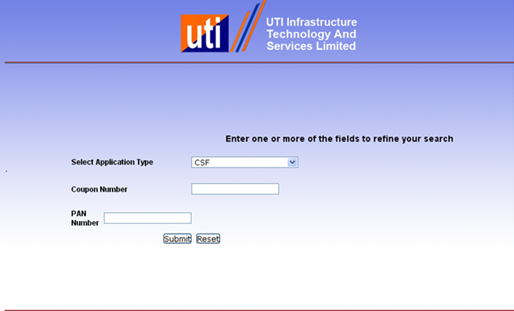

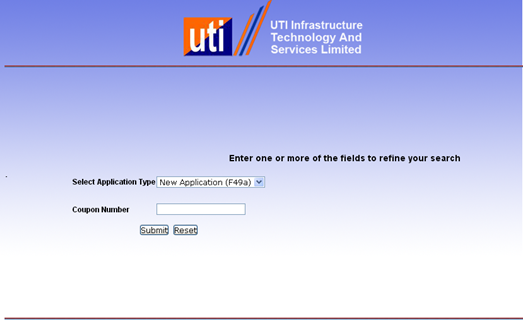

- Additional Information for applying Permanent Account Number (PAN) and Tax Deduction Account Number (TAN): Details should be entered only if you want to apply for PAN or TAN and application is filed via e-biz service where application process is active

- Source of Income: If you want to apply for PAN or TAN

- Business/ Profession Code: If the source of income of the proposed company is Income from business/profession, enter the Business/ Profession Code.

- Additional Information for Employer registration under Employee State Insurance Corporation (ESIC): In case you want to apply for employer registration via e-biz service, enter the details for Employer registration

- List of Attachments with INC 29: Memorandum of Association, Articles of Association, Affidavit and declaration by first subscriber(s) and director(s), Proof of office address, Copies of utility bills that are not older than two months, Approval of the owner of the trademark or the applicant of such trademark for registration of Trademark, Proof of relation of the relative with promoter, NOC from the sole proprietor/ partners/other associates/ existing company, NOC from any other person, Copy of certificate of incorporation of the foreign body corporate and resolution passed, Resolution passed by promoter company, A certified true copy of No objection certificate by way of board resolution, Interest of first director(s) in entities, Consent of nominee, Proof of identity and residential address of the nominee, Proof of identity and residential address of the subscribers, Proof of identity and residential address of such director, Proof of identity and residential address of such director, Proof of identity and residential address of such director

- Digital Signature: Ensure the eForm is digitally signed by the Director and shall be certified by the practicing professional.In case the person digitally signing the eForm is a Director – Enter the approved DIN or valid PAN. In case the person digitally signing the eForm is practicing CA/CS/CWA – Enter valid membership number. In case the person digitally signing the eForm is an Advocate- Enter valid PAN.

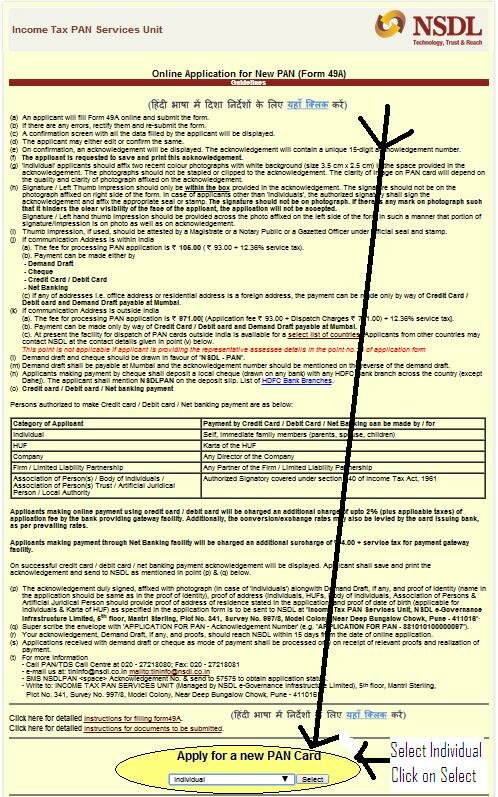

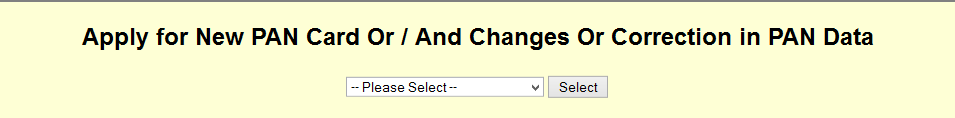

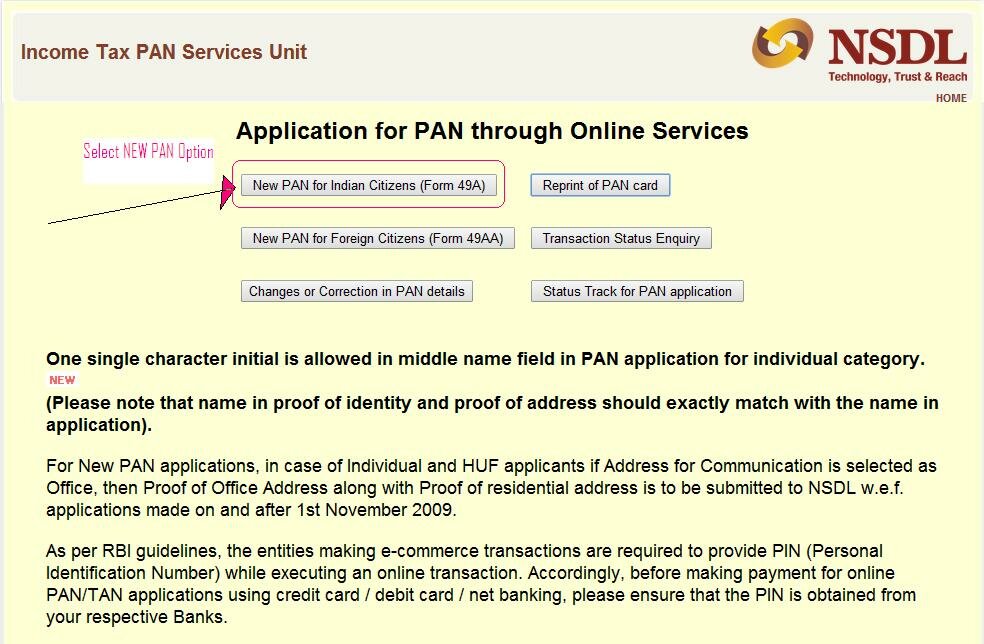

After Selecting NEW PAN APPLICATION Option New Screen will Open

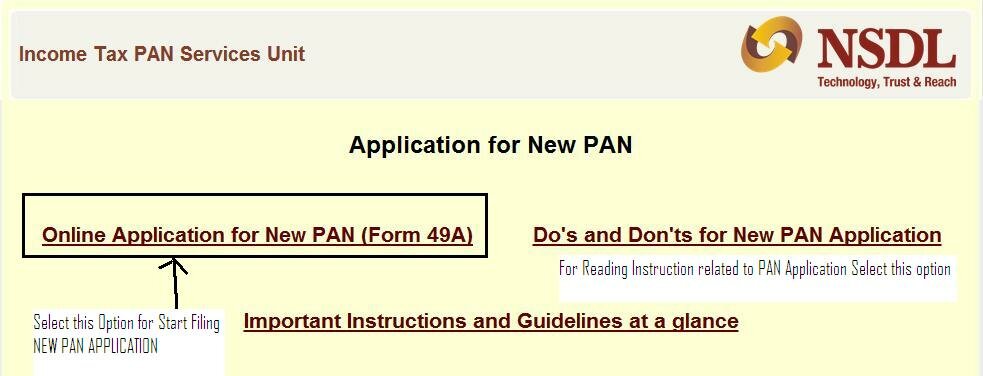

After Selecting NEW PAN APPLICATION Option New Screen will Open Before Selecting Online Application for New PAN(Form 49A) please read Do’s and Don’t for New Application Option, Important Do’s and Don’t for New PAN Card Application

Before Selecting Online Application for New PAN(Form 49A) please read Do’s and Don’t for New Application Option, Important Do’s and Don’t for New PAN Card Application