Download Uttrakhand Vat FORM XXVI: Application For The Issue Of Duplicate Refund Voucher

As per Uttrakhand vat Rule 41 Refund under Section 36 :

(1)Refund shall be made through a refund voucher after adjustment towards any amount outstanding against the dealer for the same or any other assessment year and in accordance with the rules contained in this Chapter.

(2)When a claim for refund is made, the Assistant Commissioner shall, after proper scrutiny of all the relevant records and necessary verification, satisfy himself that the amount is refundable. If no dues are outstanding against the dealer for any year, the refund voucher shall be prepared. If any dues are outstanding against the dealer for any year or if the dealer makes a request for adjustment of the refundable amount against future dues, an adjustment voucher shall be prepared for the adjustment of the refundable amount towards such dues.

(3)Before a refund or an adjustment voucher is signed entries about the refund shall be made in all the relevant records including Daily Collection Register, Dealer’s Ledger, Demand, Collection and Arrear Register, Register of Refunds, order sheet of the relevant assessment files, order directing the refund and copies of all relevant treasury challans. All such entries shall be authenticated under the dated signatures of the Assessing Authority. The refund voucher passed by the Assessing Authority shall also be countersigned by the Drawing and Disbursing Officer:

Provided that refund voucher of an amount exceeding twenty five thousand rupees shall be countersigned by the Joint Commissioner (Executive) of the region.

(4)The adjustment voucher shall also be signed by the Assistant Commissioner for payment received by adjustment. Four copies of the treasury challan in Form VI duly filled in as for deposits made by a dealer, shall also be attached to the voucher before it is sent to the treasury for adjustment. The adjustment voucher passed by the Assistant Commissioner shall also be countersigned by the Drawing and Disbursing Officer.

(5)After verifying the entries of the adjustment voucher from his records, the Treasury Officer shall refund the excess amount and then take the same amount as deposited by adjustment for the year mentioned in the challan enclosed with the voucher. Two copies of such challan shall then be forwarded to the Assistant Commissioner who shall deliver one copy to the dealer concerned for his record.

(6)Simultaneously, with the issue of a refund voucher, an advice note shall be sent direct to the State Bank of India, treasury or sub-treasury, as the case may be. The advice note shall bear the same serial number as mentioned on the refund voucher issued. No refund shall be given by the State Bank of India, Treasury Officer or the Sub-Treasury Officer, till the advice note is received by it.

(7) All entries in the refund voucher and the advice note shall be made in ink, and correction, if any, shall be attested under the full dated signature of the Assistant Commissioner.

(8)The refund voucher shall be made payable at any branch of the State Bank of India conducting treasury business, or at the treasury or sub-treasury, where there is no such branch of the State Bank of India. The refund voucher shall be non-transferable.

(9)Every refund voucher for Rs.2000/-or above issued on the State Bank of India shall be crossed and made payable to the payee’s account only. The voucher issued on the treasury or sub-treasury shall, however, not be crossed:

Provided that if the dealer has no bank account and requests the Assistant Commissioner in writing that the refund voucher should not be crossed, it may be made uncrossed but this fact shall be specifically mentioned in all the relevant records;

Provided further that every refund voucher of Rs.2000/-or above and every un-crossed refund voucher shall invariably be delivered personally to the dealer or partner or his authorised representative who shall acknowledge its receipt under his full dated signatures and complete residential address.

(10)The refund voucher shall be valid for a period of ninety days from the date of issue. If it is not encashed within this period, the dealer may, within 30 days after this period, return the voucher to the Assistant Commissioner for its revalidation. The Assistant Commissioner shall revalidate the voucher and shall make entries to this effect in the relevant Register of refund and the Book of Refund Voucher. The revalidated refund voucher shall be valid for a further period of ninety days and shall be presented to the State Bank of India or the treasury or subtreasury, as the case may be. If the refund voucher originally issued or the revalidated refund voucher is not encashed within this period, the dealer may return the voucher to the Assistant Commissioner for cancellation and apply in writing for the issue of a fresh voucher. The original voucher shall be cancelled and attached to the counterfoil by the Assistant Commissioner and fresh refund voucher shall then be issued in lieu of the returned voucher, after entries in all the relevant records have been made in respect of the cancelled as well as the new voucher according to these Rules.

(11)If the refund voucher is lost, the dealer may apply in writing to the Assistant Commissioner for issue of a duplicate voucher. The Assistant Commissioner, if he is satisfied that the original voucher has not been encashed during the period of validity, he may issue a duplicate voucher in lieu of the lost one after making necessary entries in all the relevant records according to these rules and after serving intimation of the cancellation of the original voucher to the State Bank of India, the Treasury Officer or the Sub-Treasury Officer, as the case may be.

(12) After the amount of the refund voucher has been paid, the portion of the advice note, marked ‘original’ shall be returned to the Assistant Commissioner by the State Bank of India, the Treasury Officer or the Sub- Treasury Officer, as the case may be. On its receipt, authenticated entries shall be made in all relevant records under the signature with date of the Assistant Commissioner.

(13)The book of refund voucher, adjustment voucher and of the Advice Note shall be kept in the personal custody of the Assistant Commissioner who will intimate to the State Bank of India, the Treasury Officer or the Sub- Treasury Officer, as the case may be, the book number and the serial numbers of the refund voucher, adjustment voucher and the advice note being used by him.

(14)Refund allowed during the month shall be verified with the records of the treasury in the following month for which a statement showing the details of the refund vouchers issued shall be prepared and signed by the Assistant Commissioner, and sent to the Treasury Officer. The Treasury Officer shall verify the refunds and return the statement to the Assistant Commissioner.

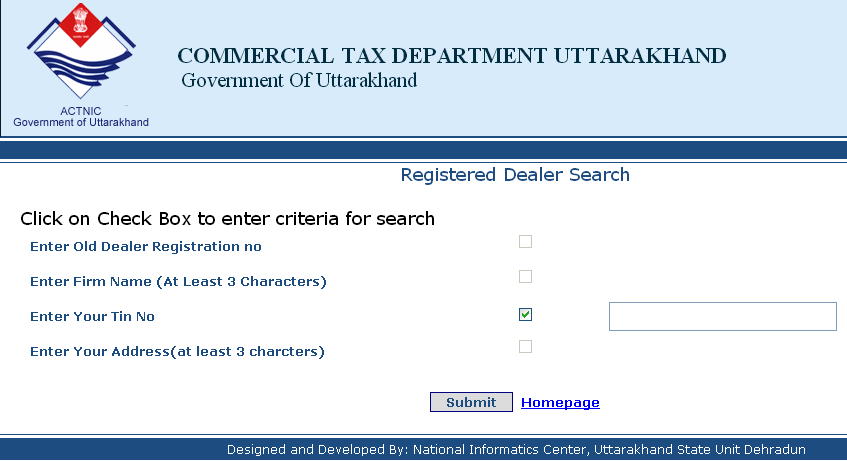

(15)The refund voucher shall be issued in Form XXIII, the adjustment voucher in Form XXIV, the advice note in Form XXV and the application for the issue of a duplicate refund voucher shall be presented in Form XXVI.

This movie requires Flash Player 9