Download P VAT FORM VAT-49 RECEIPT FOR AUCTION MONEY/ EARNEST MONEY

As per Punjab vat Rule 70

51. (1) If, with a view to prevent or check avoidance or evasion of tax under this Act, the State Government considers it necessary so to do, it may, by notification, direct for the establishment of a check post or, information collection centre or both at such place or places, as may be specified in the notification.

(2) The owner or person Incharge of a goods vehicle shall carry with him a goods vehicle record, goods receipt, a trip sheet or a log-book, as the case may be, and a sale invoice or bill or cash memo, or delivery challan containing such particulars, as may be prescribed, in respect of such goods meant for the purpose of business, as are being carried in the goods vehicle and produce a copy each of the aforesaid documents to an officer Incharge of a check post or information collection centre, or any other officer not below the rank of an Excise and Taxation Officer checking the vehicle at any place:

Provided that a person selling goods from within or outside the State in the course of inter-State trade or commerce, shall also furnish or cause to be furnished a declaration with such particulars, as may be prescribed:

Provided further that a taxable person, who sells or despatches any goods from within the State to a place outside the State or imports or brings any goods or otherwise receives goods from outside the State, shall furnish particulars of the goods in a specified form obtained from the designated officer, duly filled in and signed.

(3) At every check post or information collection centre or at any other place when so required by an officer referred to in sub-section (2), the driver or any other person Incharge of the goods vehicle shall stop the vehicle and keep it stationary, as long as may reasonably be necessary, and allow the officer Incharge of the check post or the information collection centre or the aforesaid officer to check the contents in the vehicle by breaking open the package or packages, if necessary, and inspect all records relating to the goods carried, which are in the possession of the driver or any other person, as may be required by the aforesaid officer, and if considered necessary, such officer may also search the goods vehicle and the driver or other person Incharge of the vehicle or of the goods.

(4) The owner or person Incharge of a goods vehicle entering the limits or leaving the limits of the State, shall stop at the nearest check post or information collection centre, as the case may be, and shall furnish in triplicate a declaration mentioned in sub-section (2) alongwith the documents in respect of the goods carried in such vehicle before the officer Incharge of the check post or information collection centre. The officer Incharge shall return a copy of the declaration duly verified by him to the owner or person Incharge of the goods vehicle to enable him to produce the same at the time of subsequent checking, if any:

Provided that where a goods vehicle bound for any place outside the State passes through the State, the owner or person Incharge of such vehicle shall furnish, in duplicate, to the officer Incharge of the check post or information collection centre, a declaration in respect of his entry into the State in the prescribed form and obtain from him a copy thereof duly verified. The owner or person Incharge of the goods vehicle, shall deliver within forty-eight hours the aforesaid copy to the officer Incharge of the check post or information collection centre at the point of its exit from the State, failing which, he shall be liable to pay a penalty to be imposed by an order, made by the officer incharge of the check post or information collection centre equal to fifty per cent of the value of the goods involved:

Provided further that where the goods carried by such vehicle are, after their entry into the State, transported outside the State by any other vehicle or conveyance, the burden of proving that the goods have actually moved out of the State, shall lie on the owner or person Incharge of the vehicle:

Provided further that no penalty shall be imposed unless the person concerned has been given an opportunity of being heard.

(5) At every station of transport of goods, bus stand or place of loading or unloading of goods, when so required by the Commissioner or the designated officer, the driver or the owner of the goods vehicle or the employee of transport company or goods booking agency, shall produce for examination, transport receipts and all other documents and accounts books concerning the goods carried, transported, loaded, unloaded, consigned or received for transport, maintained by him in the prescribed manner. The Commissioner or the designated officer shall, for the purpose of examining that such transport receipts or other documents or account books are in respect of the goods carried, transported, loaded, unloaded or consigned or received for transport, have the powers to break open any package, or packages of such goods.

(6) (a) If the officer Incharge of the check post or information collection centre or any other officer as mentioned in sub-section (2), has reasons to suspect that the goods under transport are meant for trade and are not covered by proper and genuine documents as mentioned in sub-section (2) or sub-section (4), or that the person transporting the goods is attempting to evade payment of tax, he may, for reasons to be recorded in writing and after hearing the person concerned, order detention of the goods alongwith the vehicle for a period not exceeding seventy-two hours. Such goods shall be released on furnishing of security or executing a bond with sureties in the prescribed form and manner by the consignor or the consignee, if registered under this Act to the satisfaction of the officer on duty and in case the consignor or the consignee is not registered under this Act, then on furnishing of a security in the form of cash or bank guarantee or crossed bank draft, which shall be equal to the amount of penalty leviable rounded upto the nearest hundred.

(a) If the owner or the person Incharge of the goods has not submitted the documents as mentioned in sub-sections (2) and (4) at the nearest check post or information collection centre, in the State, as the case may be, on his entry into or before exit from the State, such goods shall be detained alongwith the vehicle for a period not exceeding seventy-two hours subject to orders under clause (c) of sub-section (7).

(7) (a) The officer detaining the goods under sub-section (6), shall record the statement, if any, given by the consignor or consignee of the goods or his representative or the driver or other person Incharge of the goods vehicle and shall require him to prove the genuineness of the transaction before him in his office within the period of seventy-two hours of the detention. The said officer shall, immediately thereafter, submit the proceedings alongwith the concerned records to the designated officer for conducting necessary enquiry in the matter;

(b) The designated officer shall, before conducting the enquiry, serve a notice on the consignor or consignee of the goods detained under clause (a) of sub-section (6), and give him an opportunity of being heard and if, after the enquiry, such officer finds that there has been an attempt to avoid or evade the tax due or likely to be due under this Act, he shall, by order, impose on the consignor or consignee of the goods, a penalty, which shall be equal to thirty per cent of the value of the goods. In case he finds otherwise, he shall order release of the goods and the vehicle, if not already released, after recording reasons in writing and shall decide the matter finally within a period of fourteen days from the commencement of the enquiry proceedings;

(c) The officer referred to in clause (b), before conducting the enquiry, shall serve a notice on the consignor or consignee of the goods detained under clause (b) of sub-section (6) and give him an opportunity of being heard and if, after the enquiry, such officer is satisfied that the documents as required under sub-sections (2) and (4), were not furnished at the information collection centre or the check post, as the case may be, with a view to attempt to avoid or evade the tax due or likely to be due under this Act, he shall by order, for reasons to be recorded in writing, impose on the consignor or consignee of the goods, penalty equal to fifty per cent of the value of the goods involved. In case, he finds otherwise, he shall order release of the goods for sufficient reasons to be recorded in writing. He may, however, order release of the goods and the vehicle on furnishing of a security by the consignor or the consignee in the form of cash or bank guarantee or crossed bank draft for an amount equal to the amount of penalty imposable and shall decide the matter finally within a period of fourteen days from the commencement of the enquiry proceedings;

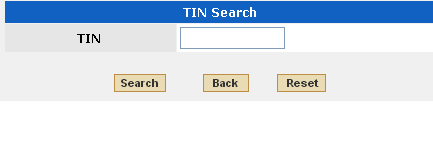

(d) The officer incharge of a check post or information collection centre or any other officer referred to in sub-section (2), may receive the amount of cash security as referred to in clause (a) of sub-section (6) and clause (c) of sub-section (7) and the amount of penalty imposed under sub-section (4) and clauses (b) and (c) of sub-section (7) against a proper receipt in the prescribed manner.

Explanation. –The detained goods and the vehicle shall continue to be so detained beyond the period specified in sub–sections (6) and (7), unless released by the detaining officer or enquiry officer against surety or security as provided for in these sub–sections or the penalty imposed, has been realized or the enquiry officer orders release of the detained goods after enquiry, whichever is earlier.

(8) In the event of the consignor or consignee of the goods not paying the penalty imposed under sub-section (7), within thirty days from the date of the communication of the order imposing the penalty, the goods detained, shall be liable to be sold by the officer, who imposed the penalty for realization of the penalty, by public auction in the prescribed manner. If the goods detained are of perishable nature or subject to speedy or natural decay or when the expenses of keeping them in custody are likely to exceed their value, the officer Incharge of the check post or information collection centre or any other officer referred to in sub-section (2), as the case may be, shall order immediately to sell such goods or otherwise dispose them off after giving notice to the consignor or consignee in the prescribed manner. The sale proceeds shall be deposited in the State Government Treasury and the consignor or consignee of the goods shall be entitled to only the balance amount of sale proceeds after deducting the amount of penalty, interest and expenses and other incidental charges incurred in detaining and disposing of the goods:

Provided that if the consignor or consignee of the goods does not come forward to claim the goods, then the entire sale proceeds, shall be deposited in the State Government Treasury and no claim for balance amount of sale proceeds shall be entertained from any other person.

(9) The officer detaining the goods shall issue to the owner of the goods or his representative or the driver or the person Incharge of the goods vehicle, a receipt specifying the description and quantity of the goods so detained and obtain an acknowledgement from such person or if such person refuses to give an acknowledgment, then record the fact of refusal in the presence of two witnesses.

(10) If the order of detention of goods under sub-section (6) or of imposition of penalty under sub-section (4), or sub-section (7) or order under sub-section (8), is in the meantime set aside or modified in appeal or other proceedings, the officer imposing the penalty shall give effect to the orders in such appeal or other proceedings, as the case may be.

(11) No person or any individual including a carrier of goods or agent of a transport company or booking agency, acting on behalf of a taxable person or a registered person, shall take delivery of, or transport from any station, airport or any other place, whether of similar nature or otherwise, any consignment of goods, other than personal luggage or goods for personal consumption, the sale or purchase of which, is taxable under this Act, except in accordance with such conditions, as may be prescribed, with a view to ensure that there is no avoidance or evasion of the tax imposed by or under this Act.

(12) Where a transporter fails to give information as required under sub- section (2) about the consignor or consignee of the goods, within such time, as may be specified, or transports the goods without documents or with ¬ ingenuine documents, he shall be liable to pay, in addition to the penalty leviable under this section, the tax due on such goods at the VAT rate applicable under this Act.

(13) The provisions of this Act shall, for the purpose of levy and collection of tax, determination of interest and recovery of tax and interest, apply to the transporter.

Explanation. – (1) For the purposes of this section, where goods are delivered to a carrier, a goods booking agency or any other bailee for transportation, the movement of the goods shall be deemed to commence at the time of such delivery and terminate at the time, such delivery is taken from such carrier, goods booking agency or any other bailee, as the case may be.

(2) For the purpose of sub-section (7), service of notice on the representative of the owner or the driver or other person Incharge of the goods vehicle, shall be deemed to be a valid service on the consignor or consignee of the goods.

This movie requires Flash Player 9