New ITR Released For A.Y. 2015-16

New ITR Form ITR-1, ITR-2, ITR-4S for A.Y. 2015-16 (Financial Year 2014-15) has been released by the Income Tax Department for physical filing i.e. submitting ITR to Income Tax Department Office

The Income Tax Department releases the updated ITR every year for income tax return filing for Physical & E-filing of ITR. Income tax department has released new Income Tax Return Form vide notification 41/2015 dated 15/04/2015, while all ITR utility for E-filling is still pending .i.e. ITR 1 ITR 2 & ITR 4S are released for physical filing but ITR 3, ITR 4 , ITR 5 , ITR 6 & ITR 7 are pending.

There are few differences in old and new ITR forms (AY 2014-15 Vs AY 2015-16). Some new features includes uploading the ITR utility itself as compared to previous ITR excel utilities wherein the taxpayer was required to first prepare the xml file from the ITR utility and than manually upload on the income tax website. The new ITR java utility has the option for both manual as well as automatic upload of the Income Tax Return on the income tax website.

Further changes like: Compulsory e-filing, if refund is claimed by Assessee; No need to send ITR V to Bengaluru if you are using Electronic Verification Code system, which has been implemented by Income Tax Department from AY 2015-16.

Details of changes in New ITR as launched on 15/04/2015

ITR-1:

Introduction of furnishing AADHAR CARD Number in Income Tax Return, which will be used for EVC system. Introduction of EVC for verification of return of income filed as an option to send ITR V to CPC, Bangalore.

ITR-2:

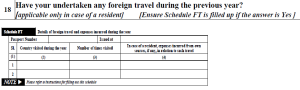

Details of Foreign Travel made if any includes Passport No., Issued at, Name of Country, No. of Times Traveled and Expenditure. In Schedule FA- Foreign Assets Disclosure: Foreign Bank Account Details are further requirement. For Non-resident, income from other sources, if any income chargeable to tax at special rate provided in DTAA, it is now required to provide details. Details of utilization of amount deposited in Capital Gain Account Scheme for years preceding to last two Assessment Years.

ITR-4S:

Details of all Bank Accounts with Bank Name, IFSC Code, Name of Joint Holder (if any), Account Number, Account Balance as on 31.03.2015 mandatory to be provided. Even those accounts which are closed during the year.

Last Date for Service Tax Return for Half Year Ending 31 March 2015 (For Oct 2014 to March 2015) LIST OF DOCUMENTS REQUIRED FOR NEW PAN CARD APPLICATION WITH INCOME TAX