Download Jammu & Kashmir VAT FORM VAT-87 ORDER OF SUSPENSION OF CERTIFICATE OF REGISTRATION UNDER SUB SECTION (7) OF SECTION 27 OF THE J&K VALUE ADDED TAX ACT, 2005

As per J&K VAT Rule 21 Suspension of Registration:-

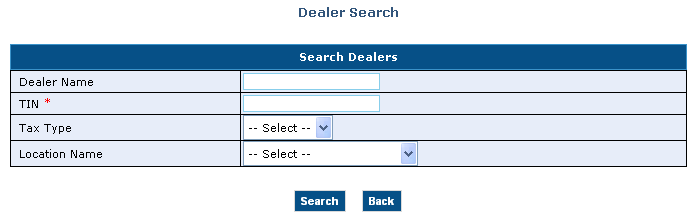

The authority who passes an order under subsection(7) of Section 27 suspending the registration of a dealer shall before doing so issue a notice in Form VAT-86 to the dealer stating there in the reasons for such an action. The order suspending the registration certificate shall be in Form VAT -87.

Section 27 Registration

(1) No dealer shall, while being liable to pay tax under this Act , carry on business as a dealer unless he has been registered and possesses a certificate of registration:

Provided that a dealer liable to pay tax shall be allowed three months’ time from the date from which he is first liable to pay such tax to get himself registered.

(2) Every dealer required by sub-section (1) to be registered shall make application in this behalf in the prescribed manner to the prescribed authority specifying therein the class or classes of goods

dealt in or manufactured, by him.

(3) If the said authority is satisfied that the application for registration is in order, he shall, in accordance with such manner and on payment of such fee as may be prescribed grant registration to the applicant and issue a certificate of registration in the prescribed form which shall specify the class or classes of goods dealt in, or manufactured, by him.

(4) Where the application for registration is made under this section, the prescribed authority shall grant to the applicant the certificate of registration from the date of filing such application:

Provided that the prescribed authority shall grant to such dealer the certificate of registration from the date of commencement of his liability to pay tax where the application for registration is made within thirty days of such date.

(5) The prescribed authority may for reasons to be recorded in writing amend, renew, suspend, restore or cancel any certificate of registration after giving the dealer a reasonable opportunity of being heard.

(6) The prescribed authority shall cancel the registration of a dealer when,-

(a) any business in respect of which a certificate of registration has been granted to a dealer on an application made, has been discontinued ;

(b) a dealer has ceased to be liable to pay tax;

(c) an incorporated body is closed down or if it otherwise ceases to exist ;

(d) the owner of an ownership business dies leaving no successor to carry on business;

(e) in case of a firm or association of persons if it is dissolved;

(f) a dealer whose registration certificate has been suspended fails to have it restored within the time prescribed ; or

(g) a person or dealer is registered by mistake:

Provided that in respect of clause (g) any amount of fee or security paid shall be refunded to such person or dealer.

(7) When any dealer to whom a certificate of registration is granted, fails to furnish any return or fails to pay any tax, penalty or interest payable under the Act, the certificate of registration of such dealer may be suspended by the prescribed Authority in the manner as may be prescribed.

(8) Suspension of certificate of registration will be withdrawn and registration certificate shall be restored on an application made by the dealer on furnishing evidence of payment of all taxes and on furnishing of overdue return or returns within 90 days from the date of suspension:

Provided that if the dealer fails to have his certificate of registration restored within 90 days from the date of its suspension, the registration certificate of the dealer shall be cancelled.

Provided also that during the period the certificate of registration of a dealer remains suspended he shall not be entitled to any of the benefits that a dealer whose certificate of registration is in force, is

entitled to.

(9) If certificate of registration of a dealer is cancelled or suspended or if the suspension is withdrawn, the information will be made public through insertion of notice in Newspapers.

(10) The cancellation of a certificate of registration shall not effect the liability of any person to pay tax due for any period till the date of such cancellation and remained unpaid or is assessed thereafter notwithstanding that he is not liable to pay tax under the Act.

This movie requires Flash Player 9