Download GVAT FORM 602: List of sales tax practitioners qualified under section 81 of the Gujarat Value Added Tax Act

As per Gujrat vat Rule 59 Qualifications of tax practitioners

(1) A tax practitioner shall be eligible for having his name entered in the list of tax practitioners maintained under section 81, if he has –

(a) passed any accountancy examination recognized by the Central Board of Revenue constituted under the Central Board of Revenue Act, 1924 (Act 4 of 1924), for the purpose of clause (v) of sub-section (2) of section 288 of the Income Tax Act, 1961 (Act 43 of 1961) and under rule 50 of the Income Tax Rules, 1962; or

(b) acquired such educational qualification as prescribed by the Central Board of Revenue constituted under the Central Board of Revenue Act, 1924 (Act 4 of 1924), for the purpose of clause (vi) of sub-section (2) of section 288 of the Income Tax Act 1961 (Act 43 of 1961) and under rule 51 of the Income Tax Rules, 1962; or

(c) held any office for a period not less than five years not below the rank of a Commercial Tax Officer in the Sales Tax Department of the Government of Gujarat and is retired or has resigned from such office:

Provided that for the first two years immediately after his retirement or resignation from the Sales Tax Department the person referred to in clause (c) shall not be qualified to practice before any tax authority except the Tribunal:

Provided further that a member of the Tribunal constituted under the earlier law or this Act shall not, for a period of five years after retirement or otherwise ceasing to be the member of the Tribunal, practice before any sales tax authority or the Tribunal.

Explanation. – A person who has been removed or dismissed from Government Service shall not be eligible for the purposes of clause (a), (b) or (c) of this sub-rule.

(2) A tax practitioner who is eligible to appear in a proceeding under the Act before any authority appointed under section 16 shall on application made in writing to the Commissioner in Form 601 be entitled to have his name entered into the list referred to in sub-rule (3).

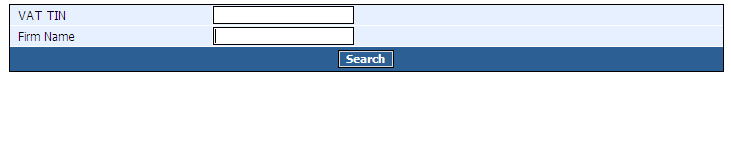

(3) The Commissioner shall maintain a list of all tax practitioners in Form 602 who are entitled to attend in a proceeding before an authority appointed under section 16 and shall, up date the list from time to time.

(4) The tax practitioner entitled to have his name entered in the list maintained under section 81 and whose name stands entered immediately before the appointed day, in the list which was maintained by the Commissioner under rule 71 of the Gujarat Sales Tax Rules, 1970, shall be deemed to have his name duly entered on the appointed day, in the list maintained under this rule.

This movie requires Flash Player 9